Az State Tax Rebate 2025

Az State Tax Rebate 2025. And she is doing so despite the fact. Enter the qualifying tax return information from tax.

Income tax credits are equal to 30% or 35% of the investment amount and are claimed over a three year period. $470 single, married filing separate or head of household;

You can use this page to check your rebate status, update your rebate address, or to make a claim for your rebate.

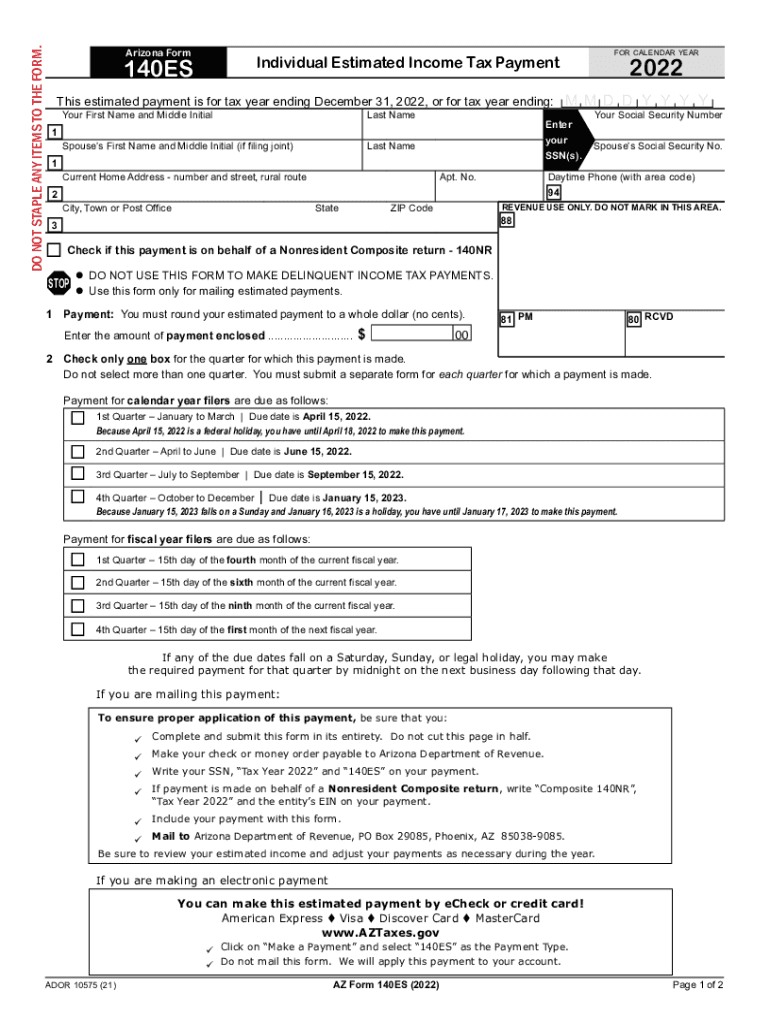

Arizona Estimated Tax Payments 20222024 Form Fill Out and Sign, Income tax credits are equal to 30% or 35% of the investment amount and are claimed over a three year period. Katie hobbs is claiming credit for a $260 million tax rebate to families that she didn't want in the budget.

IRS Will Tax Arizona Families’ Tax Rebates CPA Practice Advisor, So, everything else being equal, someone getting a $500 rebate whose income is in the 22% bracket — from $44,726 to $95,375 for individuals — will be giving. The maximum qco credit donation amount for 2025:

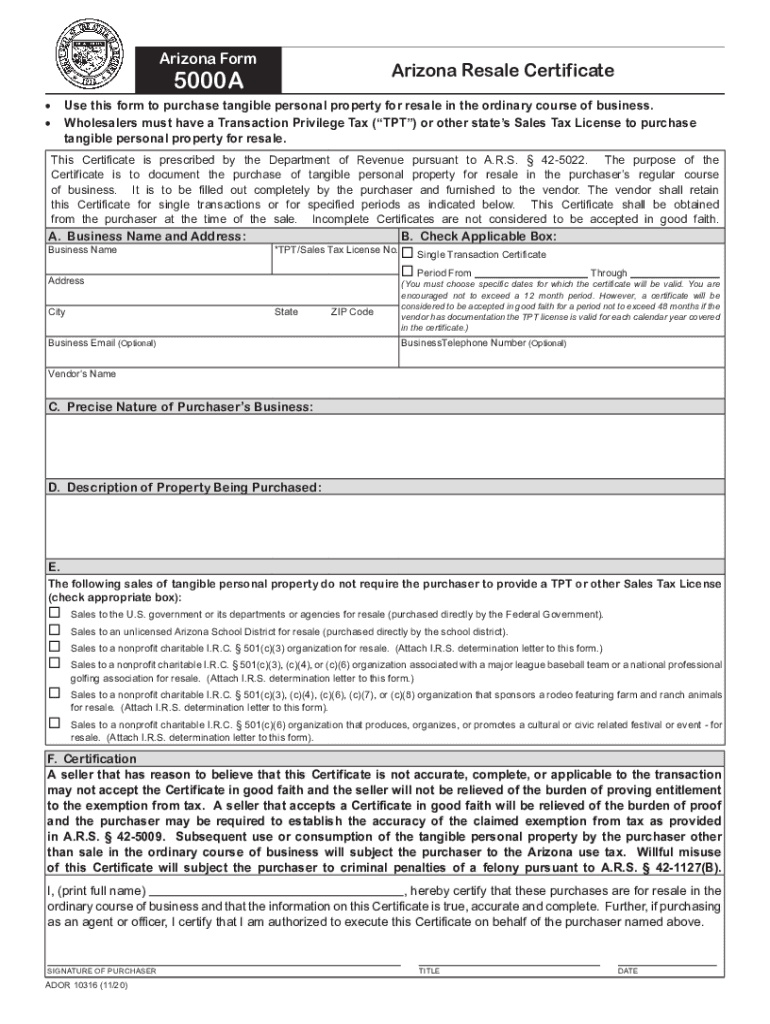

20202024 AZ Form 5000A Fill Online, Printable, Fillable, Blank pdfFiller, Arizona individual income tax highlights for details on. The governor says eligible families will have an opportunity to receive up to $750 in tax rebates, with funds made possible by the latest bipartisan budget.

20212024 Form AZ DoR 5000 Fill Online, Printable, Fillable, Blank, Yes, arizona is introducing a new tax rebate in 2025. Mayes claims that the irs’s decision to tax the rebates means arizonans will be forced to pay $20.8 million in federal taxes that would otherwise stay in the state —.

Tax rates for the 2025 year of assessment Just One Lap, As with federal income tax returns, the state of arizona offers various credits to taxpayers. The maximum qco credit donation amount for 2025:

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, An individual may claim itemized deductions. Irs will tax arizona families’ tax rebates.

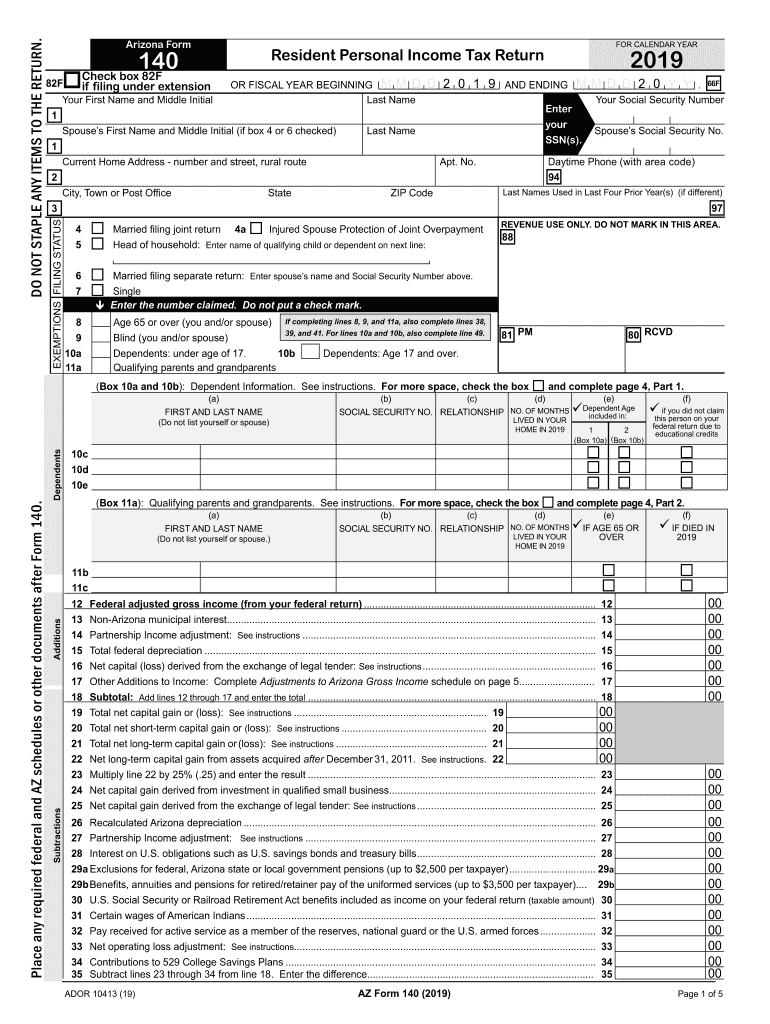

Arizona 140 tax form 2025 Fill out & sign online DocHub, Enter the qualifying tax return information from tax. Arizona previously had four tax brackets with rates that ranged from 2.59% to 4.5%.

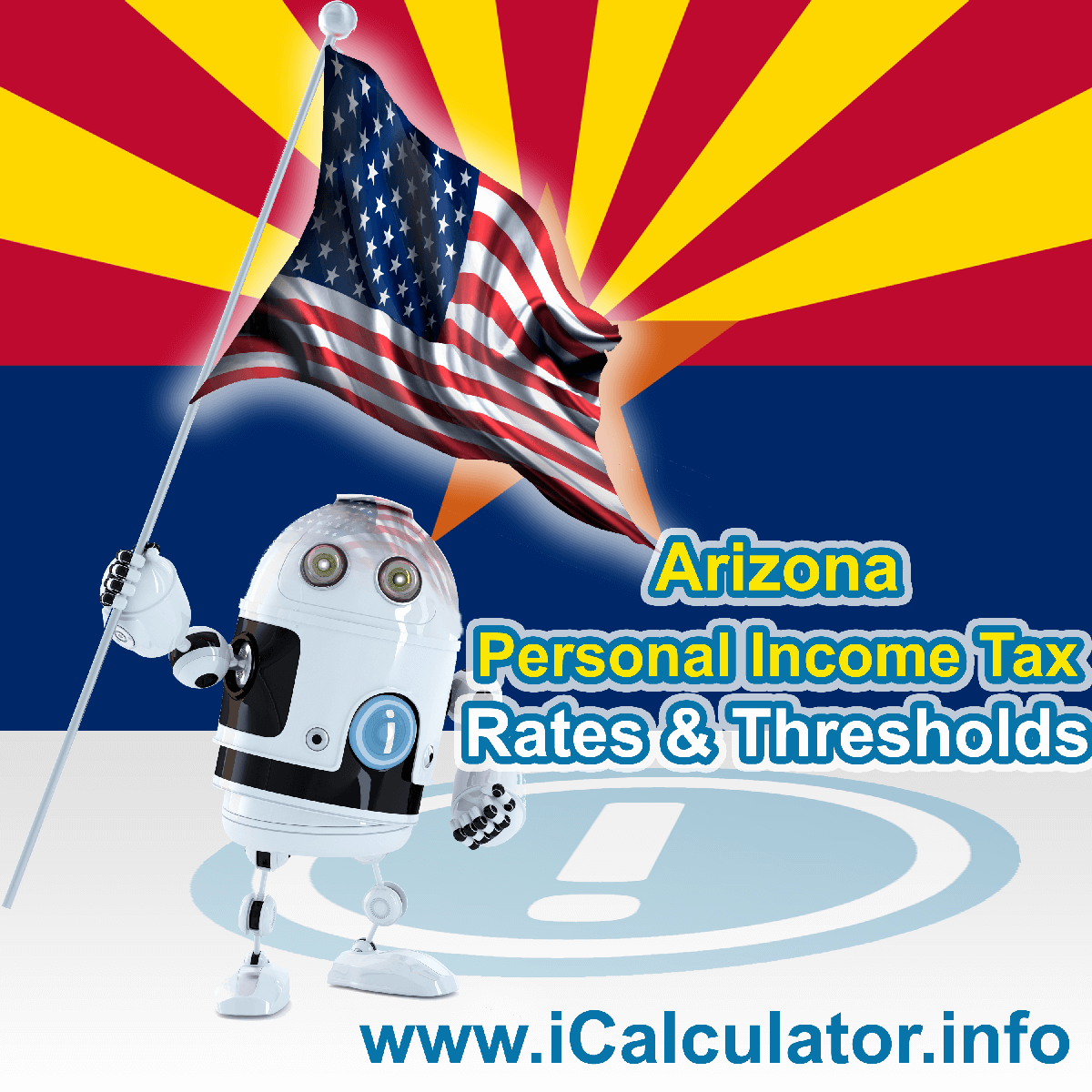

Arizona State Tax Tables 2025 US iCalculator™, Mayes claims that the irs’s decision to tax the rebates means arizonans will be forced to pay $20.8 million in federal taxes that would otherwise stay in the state —. In 2025, those brackets were downsized to two, with rates of 2.55% and 2.98%.

Arizona State Tax Withholding Form 2025 Printable Forms Free Online, For dependents under 17, the rebate is $250 per child. In 2025, those brackets were downsized to two, with rates of 2.55% and 2.98%.

Arizona State Taxes Taxed Right, Katie hobbs is claiming credit for a $260 million tax rebate to families that she didn't want in the budget. You can use this page to check your rebate status, update your rebate address, or to make a claim for your rebate.

During state budget negotiations, lawmakers allocated approximately $260 million to create the arizona families tax rebate.